Can Smoke-Free Products Power Philip Morris' Next Decade of Growth?

Can Smoke-Free Products Power Philip Morris' Next Decade of Growth?

Philip Morris International Inc. PM is rapidly transforming its business model to align with the global shift toward reduced-risk products. In the first quarter of 2025, smoke-free products accounted for 44% of the company’s total gross profit — an impressive milestone that reflects its serious push to become a majority smoke-free firm.

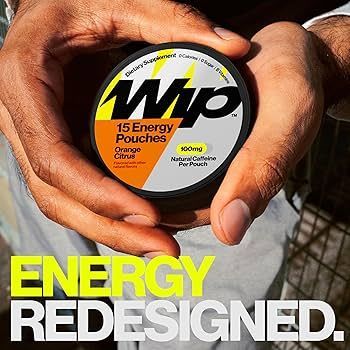

At the heart of Philip Morris’ transformation is its multi-category strategy, led by IQOS, ZYN and VEEV. IQOS, a scientifically backed heat-not-burn device, continues to gain traction globally, delivering 9.4% HTU-adjusted IMS growth in the first quarter despite regulatory headwinds in Europe. Meanwhile, ZYN's performance in the United States has been exceptional, with shipments up 53% year over year to 202 million cans.

Article Summary:

- PMI's Smoke Free Vision.

With products available in 95 markets and almost 38.6 million adult users globally, PM’s smoke-free vision is materializing. Backed by scientific innovation, strategic partnerships and manufacturing investments, the company is on a clear path to achieving a majority smoke-free future. - PMI’s Competition in the Smoke-Free Category.

Altria Group, Inc. MO and British American Tobacco p.l.c. BTI are the key tobacco companies competing with Philip Morris in the smoke-free category. - PMI’s Price Performance, Valuation and Estimates.

Shares of Philip Morris have rallied 51.4% year to date compared with the industry’s growth of 38.5%. From a valuation standpoint, PM trades at a forward price-to-earnings ratio of 23.27X, above the industry’s average of 15.46X.