Alp's Momentum Accelerates, But Upside Is Limited.

Moist? Moister? Moistest... Alp's Momentum Accelerates, But Upside Is Limited.

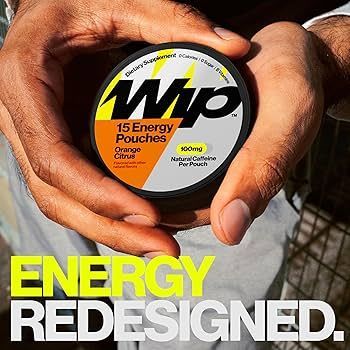

Turning Point Brands' Q1 results showed very strong nicotine pouch momentum, growing by nearly ten-fold through Alp's and Fre's momentum.

Could the addition of a TRULY MOIST Nicotine Spray, Sublingual and Inhaler to Turning Points portfolio change the narrative to an UNLIMITED upside prediction?

Tucker and ALP. Instagram Post.

We would be very curious to learn of other nicotine pouch users experience related to the SMELL of a nicotine pouch. We don't get the smell. Wouldn't a MOIST nicotine pouch smell much more than a dry pouch? Just curious.

Turning Point Brands, Inc. (TPB) reported the company’s Q1 results on the 7th of May, showing a great start to 2025 from the nicotine product & rolling paper company. The report underlines TPB’s fast momentum in nicotine pouches, driven by surging interest in brands Alp and Fre as well as general growth in the product category. Zig-Zag brand offset some of the momentum, but the report was clearly bullish based on Alp’s momentum. At the time of writing, TPB is up 19% thanks to the strong report.

TPB’s Nicotine Pouch Narrative Is Accelerating. TPB’s Q1 report clearly exceeded expectations. Revenues came in at $106.4 million, up by 28.1% year-on-year and beating Wall Street’s consensus by a $10.7 million margin. Along with great revenue growth, the adjusted EPS of $0.91 beat Wall Street’s consensus by $0.13. As the weakly performing CDS segment is now in discontinued operations, the quarter showed TPB’s great and improving underlying growth.

Behind the momentum, TPB’s entry into nicotine pouches through Fre and Alp is already showing great results.

The Stoker’s segment reached revenues of $59.2 million with massive growth of 62.7% with strength across the segment’s brands. Moist smokeless tobacco sales grew by low double-digit percentages and loose-leaf by low single-digit percentages, whereas nicotine pouches experienced nearly ten-fold year-on-year growth to a total of $22.3 million in Q1 revenues alone. The increase in Stoker’s segment revenues was accompanied by a 30 basis point expansion in the segment’s gross margin to 57.5%.

Takeaway

TPB reported a great Q1 as the company’s nicotine pouches are gaining momentum. Zig-Zag’s quarter was more subdued, but Alp’s continued success overwrites the rolling paper business’s weak growth. Margins took a small hit from Zig-Zag and higher Alp-related operating expenses, but TPB’s long-term margin prospects remain intact. Even with raised financial estimates, I don’t believe TPB to have significant base scenario upside. As such, I remain with a Hold rating.